Multifamily real estate investment gains popularity mostly because of the possibility to use leverage. Since I’m the one who introduced financial engineering to Quebec’s market, I’m obviously the first to encourage its use. Besides, it’s really common, in multifamily real estate coachings, to teach how to maximize leverage through “creative financing.” However, it’s important to use your good judgment when using this technique. In fact, it’s the easiest way to generate massive wealth but is also the easiest way to lose a lot of money.

Definition

Leverage consists in borrowing money to buy a building, so it produces greater return than what the loan cost itself. Therefore, the profits made through debt become greater than the debt value.

An investor who buys a building with just 25% down payment uses, consequently, a 75% leverage, also known as loan-to-value ratio.

For instance, according to a common misconception, interest rate would be the most important part of a mortgage. However, a skillful investor knows that, depending on his profile and his strategy, other aspects are as just as important, if not more so:

- debt coverage ratio (DCR)

- loan-to-value ratio (LTV ratio), the term

- qualifying rate

- necessary net worth and guarantee

- amortization

CHOOSE YOUR MORTGAGE CLEVERLY

As you read through this text, I imagine you frown. You think the less interest you pay the more money you put into your pockets. Well, you’re not completely wrong. However, according to this mindset you engage in short-term thinking and you overlook the possible refinancing risks.

Let’s consider the example of a CMHC-insured multifamily loan, for a 6-unit building, purchased $609,000. It generates $50,000 of income the first year and $54,000 the fifth year. The building’s economic value (EV) is equivalent to the amount paid and the granted loan will be $517,000, i.e. 85%.

The first year, the DCR used to establish the EV is only 1.10. That’s to say, for each dollar of the mortgage monthly cost, the building should generate $1.10 after standardizing all expenditures. On the other hand, five years later at the time of refinancing, the CMHC will require a DCR of 1.20.

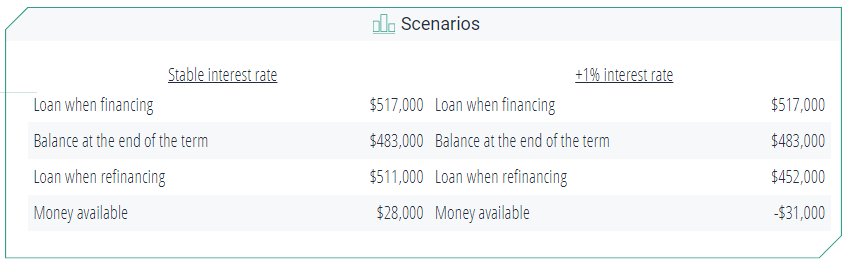

At the end of the term, there will be a $483,000 mortgage balance. When refinancing five years later, with a 1.20 DCR, the amount of the new loan will be $511,000. Also, you have $28,000 to buy a new property. So far so good!

Now, let’s apply risk management on the assumption that the interest rate has increased by 1%. DISASTER! The amount of the new loan is only $452,000! Consequently, the bank will require a new down payment to compensate for the difference between the first mortgage balance and the refinancing. Therefore, you would have to pay $31,000 from your pockets to keep a building purchased five years ago, without counting the first five years’ loss of capitalization.

Now, do you see better what I mean? Here are 5 ways to reduce risks associated to leverage that you can already apply!

1. MODEL THE EV AT THE END OF YOUR FIRST MORTGAGE TERM

The above example brings us to the first way to reduce risks: assess the EV at the end of the mortgage term. In fact, it’s insufficient to establish the current EV before buying a building. You should also calculate the potential future EV. This is modelling and for those who cannot do so by themselves, will find the next decade in multifamily real estate really harsh, believe me!

Definition

EV are calculated according to the maximum loan a building can take out, while satisfying the bank conservative criteria. Every building will have its own EV depending on the banking institution and its economic parameters:

Incomes minus the area vacancy rate (CMHC establishes percentages)

Actual expenditures + standardized expenditures (management fees and janitorial service fees, as if the building were being run by a third party, maintenance fees).

Qualifying rates (generally higher than the nominal interest rate)

DCR (the debt coverage ratio represents the link between the normalized net income and the monthly or annual debt cost, also known as debt service, which varies generally between 1.10 and 1.30).

LTV ratio (the loan-to-value ratio represents the maximum amount a banking institution would consider acceptable as leverage. Generally, it’s between 75% and 80% for a conventional loan and 85% for a CMHC-insured loan.)

Amortization, i.e. the number of years on which one calculates the loan repayment (25–40 years).

2. CONSIDER THE OPTION OF A 10 YEARS TERM

One of the easiest ways to reduce risk associated to refinancing is to consider a longer term. In Quebec, people take, generally, a 5-year term; I suppose it’s a trend. However, in the United States, most of my clients choose a 10-year term and so do the wealthiest investors too. In the above example, a 10-year term would prevent adverse consequences due to the mortgage interest rate increase.

3. AN ACTIVE PORTFOLIO MANAGEMENT

At the MREX College, in our classes and program “La meute multilogements,” we constantly repeat to our students that they shouldn’t realize the building’s financial analysis only on purchase. Actually, they should do it each year, even every trimester. The best way to anticipate risky situations is to manage your real estate portfolio actively. Therefore, it allows necessary adjustments to be made like: increasing the rent, saving money, finding new financial partners at the right moment in a planned, effective and efficient manner.

4. CONTINGENCY FUND

An excellent way to reduce risk associated to leverage is to form a contingency fund partly made up of your building’s cash flow and your own monthly savings. In the case a building doesn’t allow you to create such a fund, it means that it doesn’t correspond to your investor profile.

5. PARTNERSHIP

The last way is to join forces, because two investors allow to divide the risk, to increase purchasing power, and to obtain better financing or refinancing conditions. In addition, bank faces a lower risk, because it takes into consideration: 2 net worth, 2 drs and 2 people to provide guarantees jointly.

Finally, since the last two decades have been productive, even easy, just a few investors understand today’s market reality. Indeed, we face a growing risk in the multifamily real estate market because of the interest rates increase. Is it a reason to stop investing in real estate? Not necessarily! Is it a reason to use less leverage? Neither! However, we should become, for sure, skillful investors, more than the latest generation.