While accompanying real estate investors toward their goals, I notice a common mistake. Actually, some investors don’t take into account maintenance and future renovations in their standardization exercise. Effectively, it’s needless to adjust revenue according to the vacancy rate or based the expenditure items (maintenance, janitorial fees, management, administration, etc.) on market standard if the investors don’t adjust the price so it’s in line with maintenance and future renovations. We need to recognize that a building depreciates and sooner than later some works will be needed: change doors and windows, upgrade roofing or change kitchen cabinetry.

Did you know?

In order to compensate for the building’s deterioration, the Income Tax Act (ITA) permits to deduct its cost over a period of several years. This deduction is called “capital cost allowance (CCA)”.

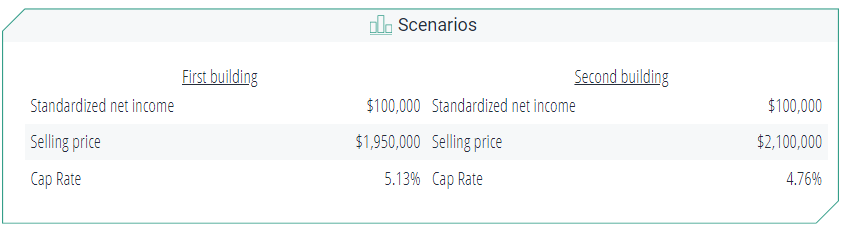

Let’s take for example two 10-unit buildings. Each of these properties generate annually a standardized net income of $100,000. In the case of this example, suppose the first building has been sold $1,950,000, i.e. at a 5.13% Cap Rate. As for the second building, it has been sold $2,100,000, i.e. at a 4.76% Cap Rate.

Which, between these two buildings, has been bought at the best price? The first one, you may say!

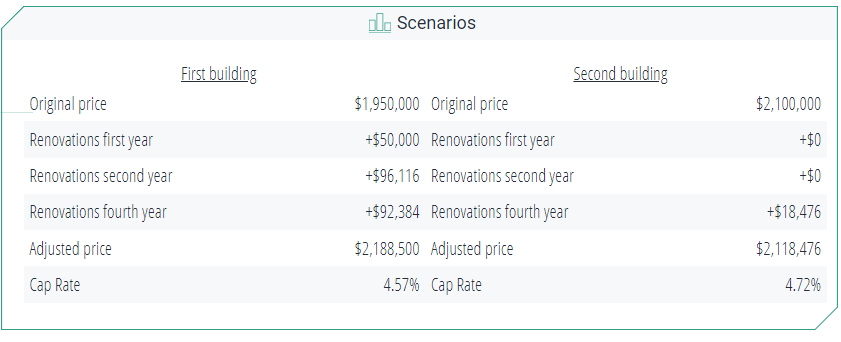

Take into consideration that the first year you’ll have to spend $50,000 in renovating the first building. Then, two years, later $100,000 and 4 years after purchase an additional $100,000. On the other hand, you’ll only have to spend $20,000 in renovating the second building for four years. Based on all this, will you change your mind?

PRESENT VALUE

We should convert the value of the future renovations in today’s dollars, while taking into account a 2% inflation rate.

As for the first building, the $50,000 allocated for renovating the building the first year stays the same. The $100,000 for renovating in two years equals $96,116 and the $100,000 in four years equals $92,384 today. That gives us an adjusted price of $2,188,500, i.e. a Cap Rate of 4.57%.

As for the second building, the $20,000 in renovations equals $18,476. The adjusted price is $2,118,476, i.e. a Cap Rate of 4.72%.

CAPEX (CAPITAL EXPENDITURES)

What I tried to prove with this article is that Cap Rate itself, taken out of context, may be misleading. Also, it’s important to verify the sources where the figures are compiled from and to make sure that the standardization has taken into account all the factors. In the current market, an income property’s value needs the assessment of maintenance and renovations (CAPEX or capital expenditures may consist in current expenditures and expenditures that can be capitalized) as well the potential increase in revenue and the possible expenditure reduction.

Nowadays, we’re facing an increased financial market. Therefore, since 2013, I remind it to every investor I help and I cannot repeat it often enough! In order to guarantee the best possible investment, financial engineering mastery is essential to every investor who wants to acquire a 5-unit (or more) building.